This will give you an idea of how much money the business needs to bring in to cover it.īut keep in mind that sales figures can change all the time depending on: If you're a new business and don't have past sales figures, start by estimating all the cash outflows. You can make adjustments to your sales forecast based on whether sales increased, decreased or stayed the same. To forecast your sales, look at last year's figures to see if you can spot any trends.

Forecast your income or salesįirst, decide on a period that you want to forecast.

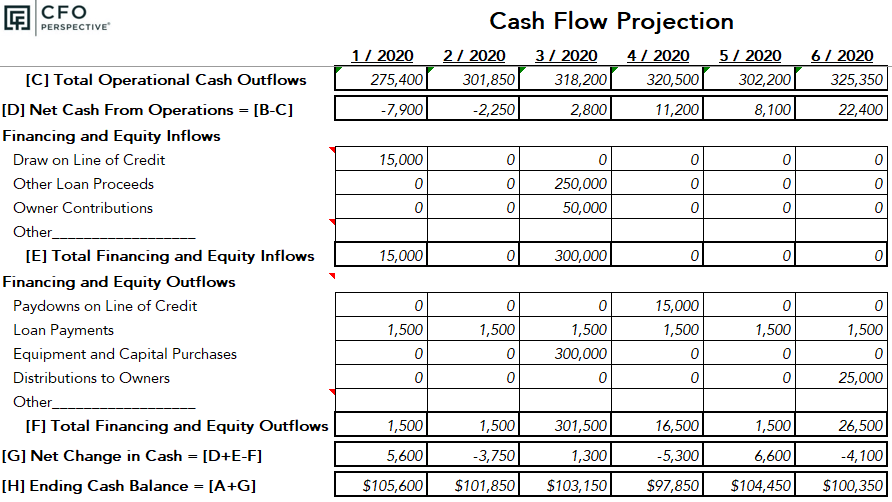

A positive cash flow will have more money coming in than going out. Your business's cash flow is represented in a cash flow statement. But it might also be money from debt repayments, selling unnecessary assets, rebates and grants. Cash flow is the amount of money that goes in and out of your business.Ĭash flowing in is most often the money you get from sales.

0 kommentar(er)

0 kommentar(er)